When President Donald Trump rolled out sweeping tariffs as part of his broader trade agenda, the ripple effects were felt immediately across the U.S. tech industry. Aimed at reducing the U.S. trade deficit and reshaping the global supply chain, these tariffs have left companies like Apple, Amazon, and Nvidia grappling with new economic pressures. While these giants may face significant losses, some software firms could see a surge in demand for their services. The question remains: can the U.S. tech industry adapt to this new reality, or will the trade policies reshape it in ways we didn’t expect?

The Initial Fallout: Tech Giants Take a Hit

The announcement of new tariffs was met with a sharp downturn in stock prices. In the hours following Trump’s speech, stocks for major tech firms such as Meta, Nvidia, Apple, and Amazon dropped significantly. Apple, in particular, stands to lose the most. With roughly half of its revenue coming from products manufactured in China and India, the iPhone maker is especially vulnerable to disruptions in its global supply chain. Similarly, Amazon, whose marketplace relies heavily on third-party merchants from China, faces increased costs and potential supply shortages.

The tech industry’s reliance on global supply chains has been a double-edged sword for years. While these networks have allowed U.S. companies to benefit from cheaper labor and production costs abroad, tariffs now threaten to undermine those advantages. The idea that consumers might be willing to pay more for American-made goods—a key tenet of Trump’s trade strategy—remains unproven. Experts like Tibor Besedes, a trade professor at the Georgia Institute of Technology, argue that there’s no evidence to suggest that U.S. consumers will tolerate higher prices on imported goods.

Inflation and Recession Fears

The broader economic impact of these tariffs has raised alarm bells among economists. Goldman Sachs recently raised the probability of a U.S. recession in the next year to 35 percent, up from 20 percent. The introduction of tariffs is likely to increase inflation, leading to higher prices for U.S. consumers. And while Trump’s administration promised to restore domestic manufacturing, the reality of rising costs and supply chain disruptions may make the U.S. economy even more vulnerable.

Besedes points out the contradiction in Trump’s policies: many Americans voted for him due to dissatisfaction with inflation under the Biden administration, and raising prices now could exacerbate that discontent. The public’s tolerance for price hikes remains uncertain, and the long-term effects of these tariffs could ultimately backfire, stalling economic growth rather than stimulating it.

The Complex Landscape of Global Trade

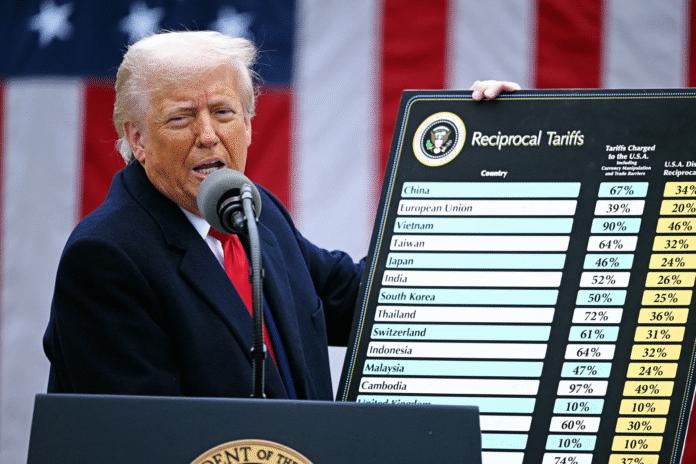

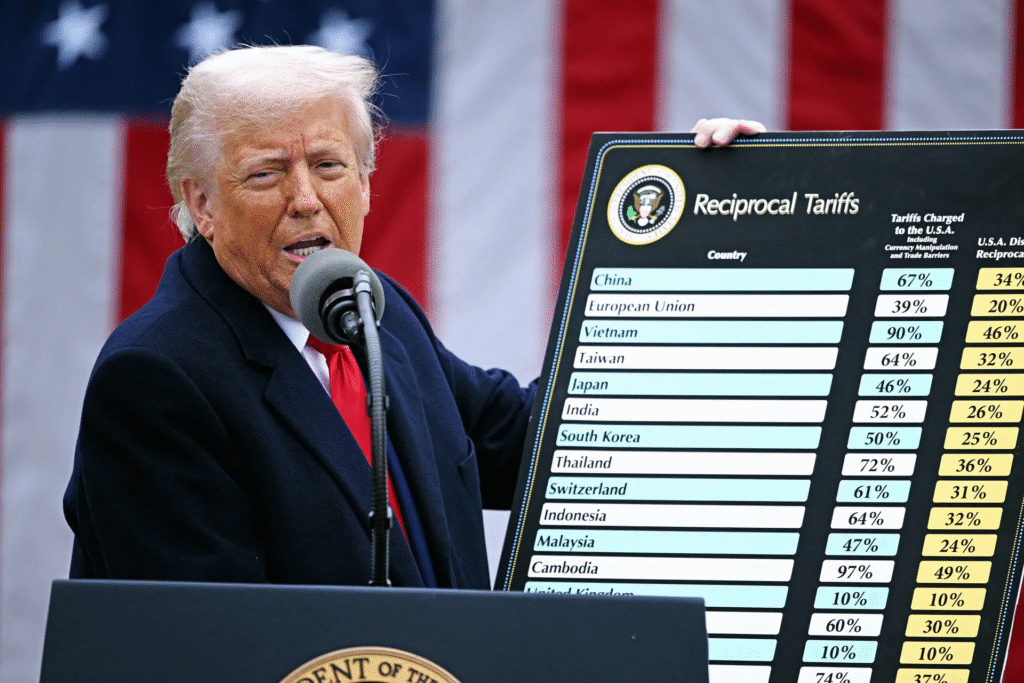

Not all tariffs are created equal, and the differences between countries affected by Trump’s new policies are striking. Some nations, like the United Kingdom and Brazil, have relatively low tariffs imposed on their exports to the U.S., while others face much higher rates. For example, China, Vietnam, India, and Thailand have tariffs ranging from 26 percent to 49 percent, which could make U.S. consumers pay significantly more for electronics, clothing, and other goods imported from these countries.

At the same time, the administration has taken steps to ensure certain critical sectors are shielded from the worst impacts. Semiconductors, for example, have been given an exemption. This is a key win for companies like Nvidia, whose high-end chips, often produced by Taiwan Semiconductor Manufacturing Company (TSMC), are central to products such as AI graphics processing units (GPUs). Without this exemption, the 32 percent tariff on Taiwanese chips could have crippled U.S. tech firms that rely on these advanced components.

However, this exemption is not without its own complexities. It’s unclear whether TSMC itself would still be subject to the blanket 10 percent tariff Trump imposed on Taiwan as a whole. Given that Taiwan accounts for roughly 44 percent of all logic chips imported to the U.S., this could be a major stumbling block for the semiconductor industry, which is already grappling with supply shortages.

A Glimmer of Hope for Software Firms

While hardware manufacturers face a difficult road ahead, the software sector may benefit from these new trade policies. As companies look to streamline their operations and reduce reliance on overseas manufacturing, demand for cloud computing, data analytics, and other software services could rise. Many businesses are likely to turn to U.S.-based software companies to help navigate the challenges posed by these tariffs, especially as they seek to adapt to new supply chain realities.

For example, firms that specialize in automation and logistics software could see increased demand as businesses seek ways to optimize production processes and cut costs. The shift towards digital services could be an unexpected silver lining for U.S. software companies, even as their hardware counterparts struggle with rising costs and trade barriers.

The Long-Term Effects: Will Tech Become Less Global?

Looking ahead, the tech industry faces a critical juncture. The tariffs represent a significant shift in global trade policy, and it’s uncertain whether they will ultimately strengthen or weaken U.S. tech companies. For hardware-dependent companies like Apple and Amazon, these tariffs could make their products less competitive on the global stage. If supply chain disruptions continue, they may be forced to pass on costs to consumers, reducing their market share.

On the other hand, the tariffs could accelerate a trend already underway in the U.S.—the push for reshoring manufacturing and reducing dependence on overseas supply chains. However, this effort could take years and would likely come with its own set of challenges, including higher labor costs and slower production times. Moreover, the effectiveness of reshoring is in question, as tech companies may simply move production to other low-cost regions, bypassing U.S. tariffs by shifting operations to places like Mexico or Vietnam.

Conclusion: A Tech Industry in Flux

Ultimately, Trump’s tariffs could reshape the U.S. tech industry in profound ways. While some companies may be able to adapt by increasing investment in software and digital services, others—especially hardware-dependent giants like Apple and Amazon—will face significant challenges. As the global trade landscape continues to evolve, the tech sector must find ways to navigate these changes and balance the tradeoff between national security concerns, economic growth, and consumer prices.

As the tech world watches closely, one thing is certain: the tariffs have created a period of uncertainty, and how companies respond will determine whether they thrive or struggle in the years to come. Whether this marks the beginning of a new era of self-sufficiency or a costly detour remains to be seen.